- Advertisement -

ITR 2020-21: There are only two days left to file Income Tax Return for Assessment Year 2020-21. The last date for filing the ITR is 31 December 2020. If you do not file your return by 31 December, then you may suffer a big loss. If you miss the deadline of 31 December, you may have to pay double the fine as compared to last year. Let me tell you that due to Coronavirus Pandemic, the Central Board of Direct Taxes (CBDT) had extended the date of filing ITR for the financial year 2019-20 to 31 December 2020.

Also Check: SBI giving Free facility to file ITR through YONO App, know what will be its process

Usually taxpayers file ITR by 31 July, but due to the pandemic this year, the date has been extended. Therefore, if you have not yet filed the return, then you have only two more days.

Will be fined 10 thousand rupees

Last year, the penalty on filing income tax returns after the deadline was only Rs 5,000. But this time, taxpayers who finalize the returns after 31 December will face a fine of Rs 10,000. However, this penalty or late filing fee will be applicable only if the net total income of the taxpayers (ie the proposed deduction and income after tax exemption) exceeds Rs 5 lakh in the financial year.

File ITR like this

Also Read: How to file ITR-1 Sahaj form online: All you need to know(Opens in a new browser tab)

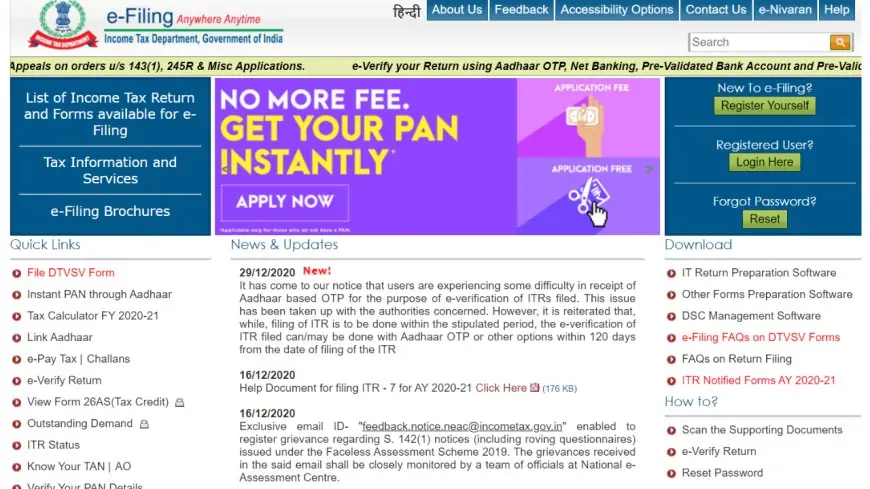

You can also file returns through the income tax website. For this, go to www.incometaxindiaefiling.gov.in. After this, enter the user ID PAN, password, date of birth, and captcha code and login. Then proceed with the given process and fill your return. As the last date for filing income tax returns draws near, the Income Tax Department has started ‘Instant Processing’ to make the return filing easier. If you have not yet filed an income tax return, then use this new facility and file the return soon.

Also Read: Front-end Developer Resume: Complete Guide & Samples [2020]

This is how to verify ITR

ITR has to be verified within 120 days of uploading. Come learn about it.

(I) through Aadhaar OTP

(II) By logging into e-filing account through net banking

(III) Through Electronic Verification Code (EVC)

(IV) Send the signed copy of ITR-V to Bangalore.

- Advertisement -

![[WATCH VIDEO] Kristina Koko In India Viral Video Story - Download Video Showing her Private Parts [WATCH VIDEO] Kristina Koko In India Viral Video Story - Download Video Showing her Private Parts](https://www.sociallykeeda.com/uploads/images/202402/image_140x98_65bdef6f1a7a4.webp)

![[WATCH VIDEO] Areeka Haq (14th) Valentine Video Leaked Scandal: Is It On Instagram, Youtube, Telegram [WATCH VIDEO] Areeka Haq (14th) Valentine Video Leaked Scandal: Is It On Instagram, Youtube, Telegram](https://www.sociallykeeda.com/uploads/images/202402/image_140x98_65d349d7732e5.webp)