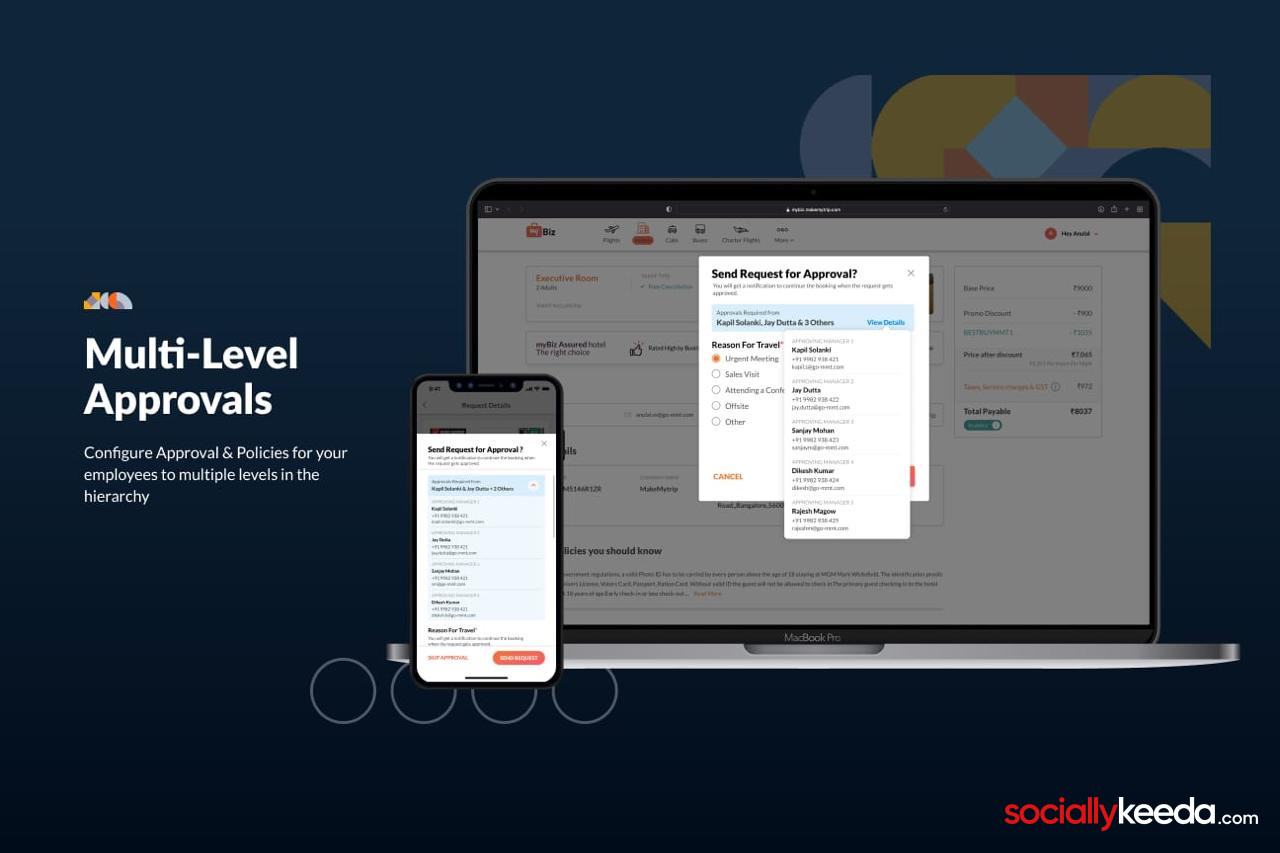

Stripe has taken the covers off a brand new financial reporting device designed to simplify a key facet of time-sapping accounts processes for SaaS businesses.

Its new Revenue Recognition device has been engineered so it will probably automate most of the aspects of income recognition, together with when a buyer receives a product or makes use of it, as opposed to after they paid for it.

The transfer will assist to extra successfully doc buyer conduct, particularly when it comes to income recognition, which is a central a part of Generally Accepted Accounting Principles or GAAP.

Revenue recognition has lengthy been a posh and difficult prospect for many businesses, particularly those that function subscription-based or recurring income preparations. Traditionally, income recognition has been a largely guide process whereby finance employees beforehand wanted to log particulars by way of an Excel spreadsheet.

Add SociallyKeeda as a Preferred Source

- Advertisement - Continue Reading Below -

- Advertisement - Continue Reading Below -

Add SociallyKeeda as a Preferred Source

Revenue Recognition

Stripe’s new Revenue Recognition device ought to assist alleviate a lot of the guide intervention by delivering automated earnings statements and income waterfall tables.

Similarly, the automated processing will log all transactions and the system may even be used to import non-Stripe transactions, additional smoothing the method of income recognition. Crucially, there’s compliance help, so businesses needn't fear about assembly widespread requirements together with ASC 606 and IFRS 15.

The new Revenue Recognition device is one other device in Stripe’s rising product portfolio. Businesses may also make use of Stripe Tax, its tax compliance device together with Stripe Identity, which helps enterprise house owners hold nearer tabs on identification verification.

Stripe introduced the newest launch yesterday and has already made the product accessible in over 40 international locations across the globe.

Via: ZDNet

![Intro Maker - music intro video editor v3.8.1 [Lifetime VIP] APK [Latest]](https://www.sociallykeeda.com/uploads/images/202312/image_870x_656c86b695c80.webp)