At LendingTree, we show you how to get the perfect deal potential in your loans, interval. By giving customers a number of provides from a number of lenders in a matter of minutes, we make comparability purchasing straightforward. And all of us know-when lenders compete for your enterprise, you win!

See Refi Offers Now(*15*)Pay quicker to save a ton

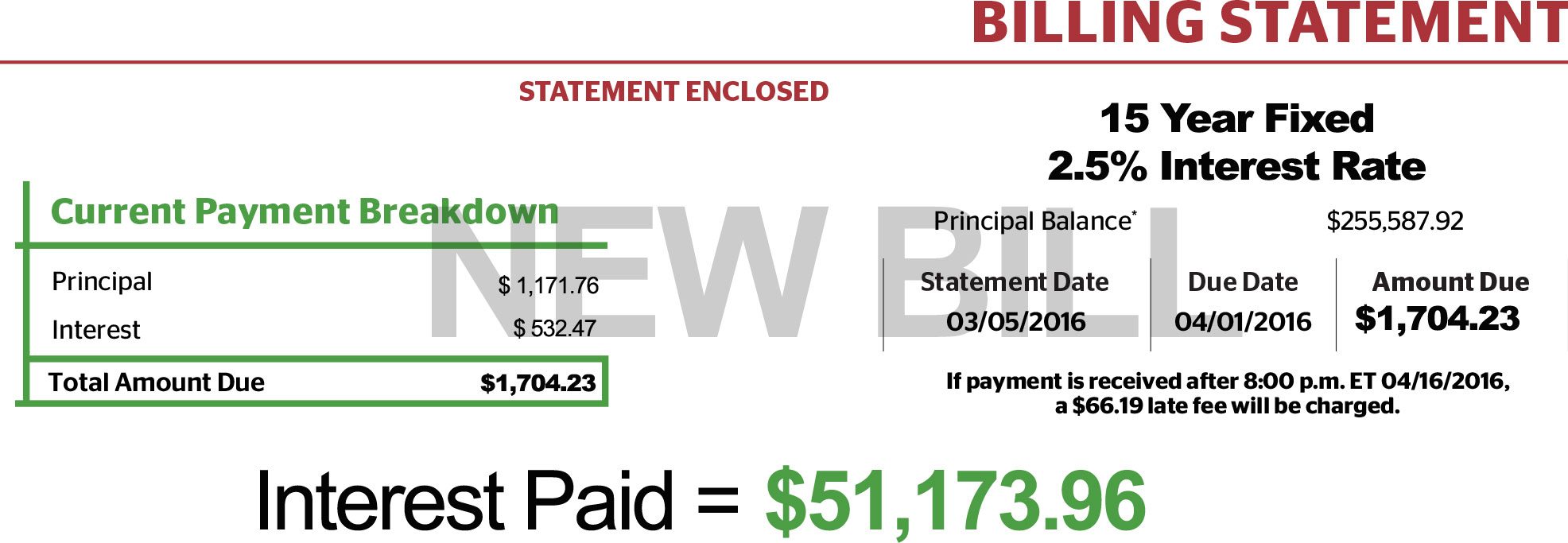

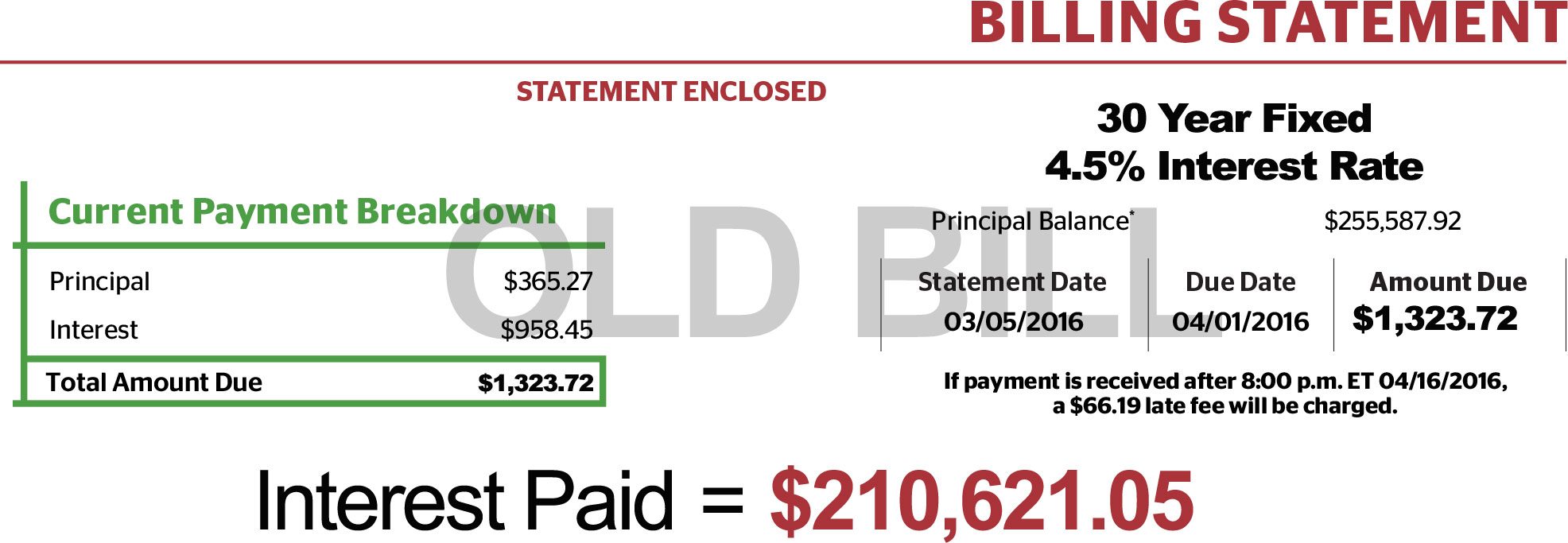

A mortgage is formally repaid if you pay again what you borrowed – the principal. But, the quantity of curiosity you’ll hand over to the financial institution is drastically affected by how lengthy it takes you to make that ultimate cost. In different phrases, you’ll get to maintain on to much more of your hard-earned money by doing one factor: paying your mortgage off quicker. If you’re in a 30-year mortgage, swap to a 15-year. Sound intimidating? It’s not — we’ll present you the way.

Do the maths (the banks want you wouldn’t)

It’s a easy equation, however bankers don’t need you to resolve it. After all, large banks make tens of millions of {dollars} from curiosity. Avoiding it isn't one thing that’s of their curiosity (pun supposed) to do.

Have you ever seen the curiosity accrued in your bank card, car or scholar mortgage assertion and been shocked by the overall you see? It occurs to folks on daily basis! Take this account from a borrower writing on morningfinance.com: when he put pencil to paper, it turned out that 72% of the month-to-month cost on a 30-year mortgage was going straight to curiosity. By switching to a 15-year mortgage, he may save $159,447.09 in pure curiosity.

Compare charges to safe essentially the most financial savings

By now you perceive that your financial savings are reliant in your rate of interest. There’s just one manner to make sure that you get the perfect rate of interest out there, and that's to evaluate charges from banks throughout the nation. Sound inconceivable? Not with LendingTree. LendingTree makes banks compete for your enterprise. The LendingTree web site is quick, the service is free, and the outcomes are yours with no obligation. What are you ready for? Cut your 30-year mortgage in half right now and thank us later.

Here’s How You Do It:

Step 1: Get began by clicking the map under.

Step 2: Once you undergo just a few questions, you should have the chance to evaluate the quotes from a number of lenders!