The technology market is preparing for one of the year's most anticipated events. Cloud design service Figma has officially applied for an initial public offering. The application to the U.S. Securities and Exchange Commission is non-confidential. The initial step was taken in April. According to the latest plans, the aim is to raise up to $1.5 billion to strengthen competition with such titans as Adobe and Canva.

In addition, the IPO decision is driven by deeper AI integration, the expansion of the user base, and investor attention. The company may also eventually be included in the leading stock indexes, such as the S&P 500 Index.

The fresh financial data from the application shows strength. Figma shows growth in all key metrics:

-

Revenue in Q1 2025 is $228.2 million, a 46% increase compared to last year. This is above the market average and an obvious signal of high demand.

-

Net profit in Q1 2025 is $44.9 million, which is a notable jump from $13.5 million in 2024 and strong profitability growth.

-

The user base has over 13 million monthly active users, with only a third of them being designers. The rest are managers, developers, and other specialists. This confirms Figma's successful strategy of becoming a platform for collaboration across roles.

-

About 85% of users are located outside the United States. However, 53% of the revenue is generated by customers from the USA. This indicates a strong monetization of the U.S. user base.

In 2022, Adobe tried to buy Figma for $20 billion, but regulators in the EU and the UK blocked the deal, fearing monopolization. Now Figma is going its own way, and the IPO will become a step toward independence.

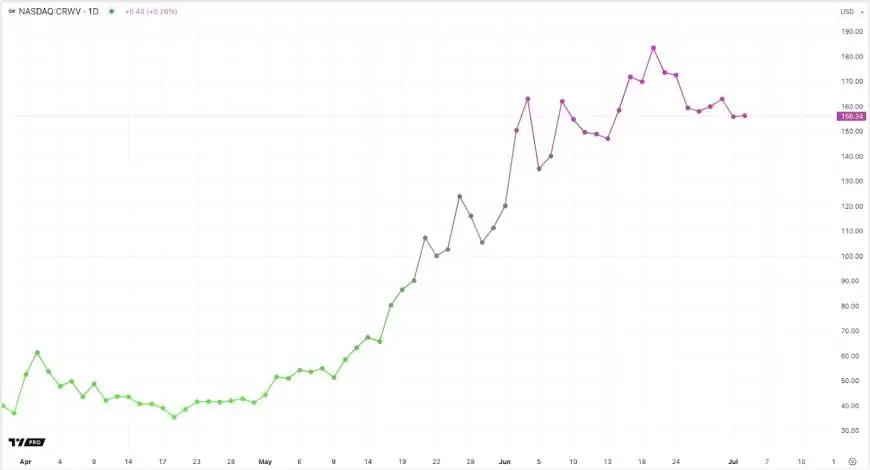

Unfortunately, the number of shares and the price range have not yet been disclosed. The company’s primary goal remains to raise $1.5 billion. This would make Figma's placement one of the largest technology IPOs of 2025, comparable or even superior to CoreWeave’s recent offering, which also raised $1.5 billion and holds this title so far.

Strong financial performance, particularly the profitability surge, and a massive loyal user base, create a solid foundation for successful placement. Raising capital will give Figma a powerful tool to boost its position in competition with Adobe and Canva, accelerate innovation, and create opportunities for strategic acquisitions.

The entire market will closely monitor the results of this IPO, as it evaluate Figma’s prospects and set the tone for other technology companies considering going public in the second half of 2025, especially as broader macro indicators like the Dollar Index performance continue to influence investor sentiment.

If Figma manages to repeat its operational success, then we can expect the emergence of a new significant player with global influence in the field of public technology companies.